As a school nutrition director myself, I can appreciate how much we all have on our plates even in a normal year. SY 20-21 is a whole new ballgame. We are all adapting to solving completely new problems and overcoming challenges we’ve never experienced before. I’ve worked as a school nutrition director for over 14 years and this year is very different. I feel like tasks that took minutes before can take hours, or longer, as I consider all of the new variables that go along with multiple feeding models plus staffing and food / supply challenges. It hasn’t been all doom and gloom – it’s really been an incredible experience to see our school community work together and feed and educate kids in the toughest of environments.

Financial Uncertainty

When schools closed last spring, our school nutrition financial situation was turned upside down. We still had overhead expenses to pay with either no (or limited) revenue to cover those expenses. All districts were impacted and financial damage varied by district. As we started SY 20-21 without SFSP/SSO waivers and funding, things were looking pretty bleak financially. How could we possibly afford to staff multiple feeding programs (virtual pickups, hybrid send homes, hybrid pickup, traditional feeding, delivery to classrooms, and more) with limited staff and decreased revenue from lost sales?

A desperately needed call was answered and here came the waivers for SFSP/SSO (a touch late for those of us already in school, but we will most certainly take it!). After we all spent the time figuring out how to backdate transactions, we had a little clearer vision of where we stood financially and may end up at the end of this school year. Or did we?

Revenue is increasing, that we know. Costs are all over the place and different than any year we’ve ever experienced before. What does that mean for my fund balance at the end of all of this? More importantly – how can I make decisions now without knowing how much money we have or will have to fund those decisions? Using past school year’s financial patterns and trends to compare to SY 20-21 is like comparing apples to oranges.

Breaking down the budget

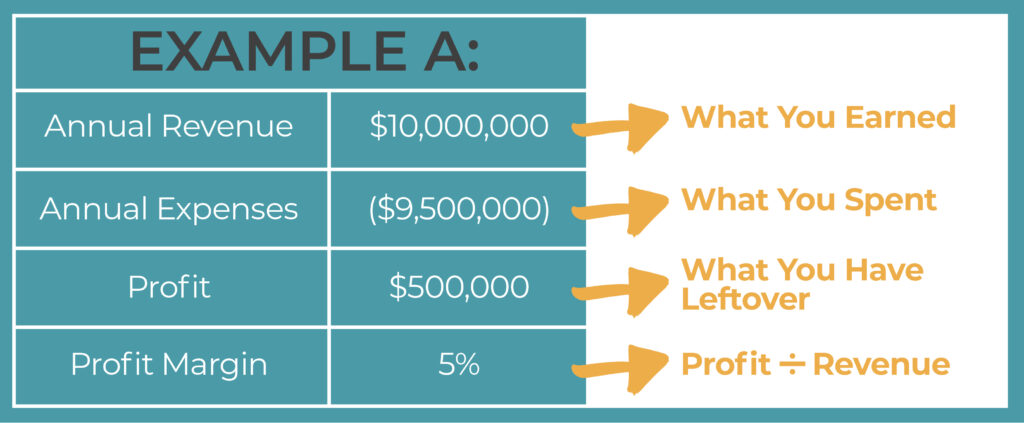

When we look at our school nutrition budget at a high level view, it could seem very basic:

Revenue (sales) minus Expenses (food, labor, supplies, other) equals Profit (or Loss)

Let’s look at an example:

Revenue is a good thing, right? We need to earn enough revenue to cover expenses and hopefully have enough funds left over to reinvest in our programs. Plus, revenue means that our students are buying what we are selling, hopefully because they are satisfied customers, which is always our goal. But revenue isn’t the whole story. If high revenue comes with high cost, is that a good thing?

Expenses

The costs of our programs include both variable costs (food, hourly labor, supplies) and fixed costs (non-hourly labor and benefits, equipment, repairs, utilities, etc). Are low variable expenses a good thing when they also come with low revenue?

Profit / Loss

In this example of an annual school nutrition budget, Profit / Loss means Revenue – Expenses = Profit (or Loss). Annual profit means there is money leftover to add to your existing fund balance, while loss means what you lost deducts from the fund balance. This can be measured by “Profit Margin”, which is a % indicator that can be used to compare businesses of different budget sizes to one another. When it’s all said and done, Profit/Loss is the information that matters. Neither revenue nor expenses tells you enough of the story.

Making sense of it all

It’s very difficult to make any sense of where our budget stands in real-time when most school nutrition departments and school districts are operating using cash-based accounting vs. accrual accounting. Cash-based means that transactions (sales, reimbursements, purchases) are tracked as of the day they went in or out of the bank. Accrual means that these same transactions are tracked as of the day they were earned or spent.

For example:

- Food and supplies are ordered on one day, paid for on another, and used across months.

- Payroll is paid on one date for days worked weeks prior.

- Sales are earned on a day but the reimbursements are deposited much later.

Given all of these factors, what can I reasonably understand from a month-end cash-based revenue and expenditure report? Not much, besides the total money that came in and out and the resulting fund balance. It’s all too jumbled together to understand what actually happened when.

If you’re like me, then you’ve tried to find ways to sort through the “what actually happened” in order to predict the “what is likely to happen”. I decided to create my own tracking spreadsheets that showed revenue when it was earned as opposed to revenue when it was deposited. I tried using starting and ending inventory to determine COGS (cost of goods sold) but ultimately this did not work. That proved to be less than reliable when the margin of error with inventory value tracking is so high and the time investment isn’t necessarily worth the flawed output for this purpose.

What if we had Real-Time Information?

So what do we do about this problem? What is the solution? The solution for me was to get this information in real-time.

Specifically: What was my profit/loss for this month? This day? That site? That meal period?

If we know how much profit or loss we had today, or yesterday, or on average, we can reasonably project out what that final profit/loss number will be at the end of the school year. But we can’t know that number without real-time information about both sides of the equation (both revenue AND expenses).

Revenue doesn’t matter unless you also know the expenses that were incurred in order to earn that revenue. This is what gives you profit/loss, which is what matters from a financial perspective. A high revenue day that also has high expenses might not be as advantageous as a lower revenue day with lower expenses. We have to know the whole story in real-time (not only revenue but also expenses) to have information that is actually useful and could drive any sort of decision-making or change.

Do you know whether you had a profit or loss today? Or last month? Do you have an idea of how this year will turn out based on what is happening now? You might be saying “Yes” or “Possibly” if I spent more time trying to find it. But I challenge you to really think this one through. Do you have all of the pieces to the puzzle to answer this?

The Power of Real-Time Information

You might be thinking – I’m just trying to get through my day. How do I have time to deal with this right now when I’m just trying to survive and feed kids? Yes, that’s true and that is our main goal. But it is also our responsibility as school nutrition leaders, to do everything we can to ensure we have the necessary funds to be able to continue to feed our students not only this school year but also in the future. If we leave this school year with depleted fund balances and no financial plan to come back from, how will this impact the quality of what we can provide to our students in the future?

When I had the realization a few years back that real-time information was the answer to so many of my problems, I was bound and determined to get it. I quickly realized that the quantity and type of data necessary wasn’t possible with POS or menu planning software and was far too complex for my spreadsheets. So, that’s why I created MenuLogic K12. In a matter of seconds, I can know how much my profit or loss was today, yesterday, which meal period, which school(s) and can easily apply that to understand what my fund balance is projected to be in June. At the beginning of this school year, that clarity allowed me to provide clear financial projections to my administration. It showed that we would need a fund transfer to be able to continue feeding students all year. Now that the SFSP and SSO waivers are in place, that financial projection is far different and significantly more positive. I know what my fund balance is projected to be and I know day by day how that projection changes. Most importantly, I can get this real time information often and instantly, which is how quickly we need it for it to be useful.

Knowledge is power. Having the information you need at your fingertips is vital. This will allow you to make decisions that will have a lasting impact on the future of your operation. Ultimately, this is the key to staying afloat not only during these trying times, but in all times. Having this knowledge not only provides peace of mind, but the confidence to know that even on the hardest of days, we can still have some level of control and influence on the outcome that we all want: happy, healthy students and bottom line.